A QUICK FRAME FOR THE WEEK

PDUFA activity is thinning into year-end, but FDA signal doesn’t disappear when decisions slow down. In quieter weeks like this, the real information is often in extensions, delays, and label mechanics, not calendar density.

This edition focuses on:

where regulatory risk is quietly accumulating,

what just resolved (and how),

and what still matters into the final days of the year.

QUIET FDA SIGNALS (WINTER MODE)

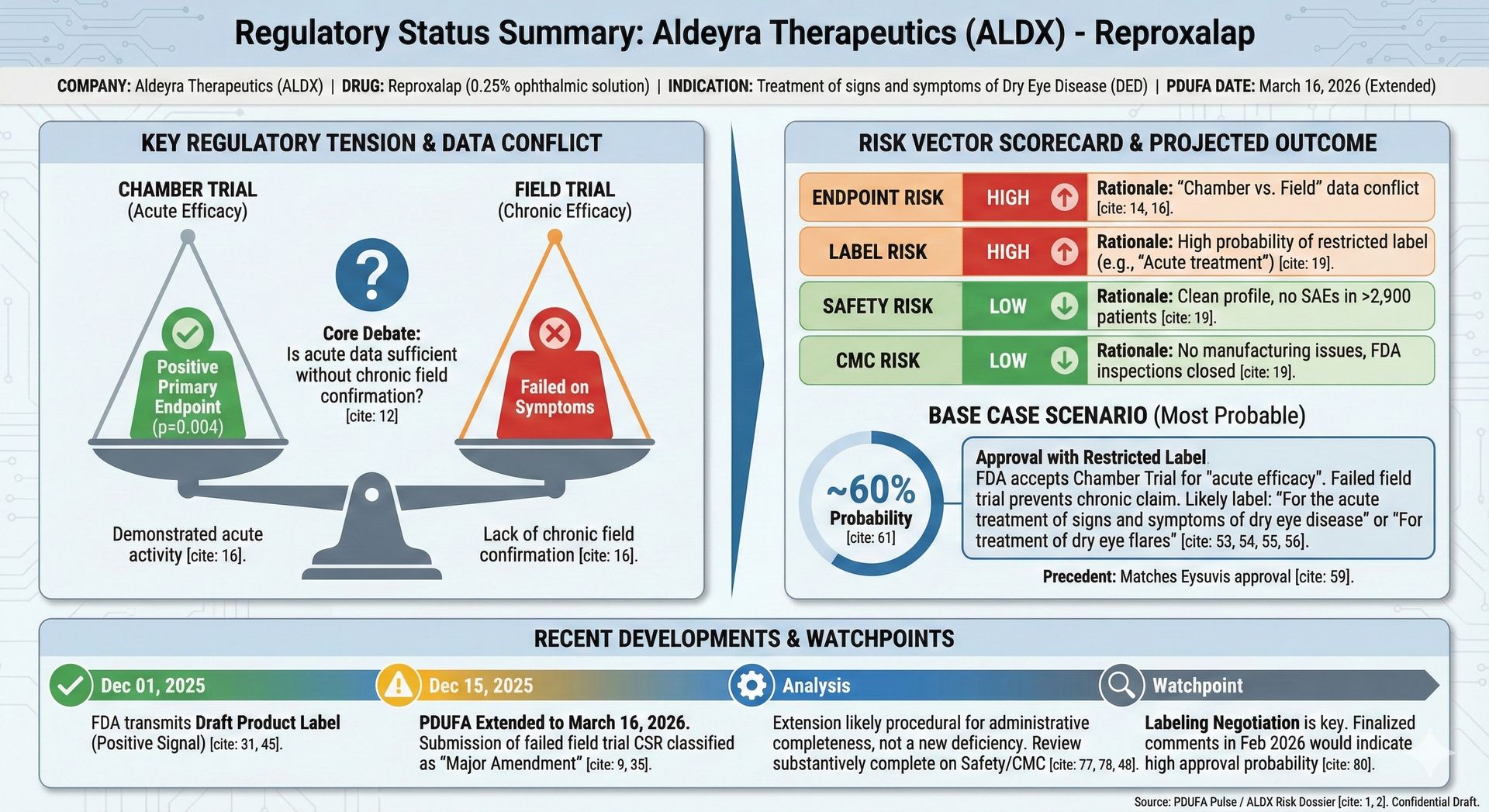

Aldeyra Therapeutics $ALDX ( ▲ 4.41% ) — Reproxalap

What was expected to be a mid-December binary is now a PDUFA extension to March 16, 2026 following a late-cycle major amendment. Importantly, this was procedural rather than punitive: draft labeling had already been transmitted, and the FDA did not surface new safety or CMC deficiencies.

In slow periods, this kind of extension is often more informative than a straight approval or CRL. It shifts focus to endpoint interpretation and label scope, not fundamental approvability.

Sanofi $SNY ( ▲ 0.19% ) — Tolebrutinib

Previously tracked for a late-December decision, Sanofi has now indicated the FDA action will likely slip into Q1 2026. This moves tolebrutinib out of the year-end stack and into the category of “quiet friction” — not a rejection, but not a clean glide path either.

RESOLVED: WHAT JUST CAME OFF THE BOARD

GlaxoSmithKline $GSK ( ▼ 0.24% ) — Depemokimab (Exdensur)

Approved last week under the brand name Exdensur for asthma, but not approved for CRSwNP. This split outcome is a useful reminder that indication-specific precedent still matters, even within the same molecule and review cycle.

Cytokinetics $CYTK ( ▲ 2.7% ) — Aficamten

Approved. With regulatory risk now removed, focus shifts entirely to post-approval dynamics and commercialization.

THE YEAR-END STACK (WHAT’S STILL LIVE)

Liquidity will be thin, and reactions may be exaggerated. Position sizing matters.

Omeros $OMER ( ▲ 0.96% ) — Narsoplimab

PDUFA: Dec 26

This date falls the day after a U.S. market holiday (Christmas), a setup that often leads to FDA actions being released late on the 24th or early on the 26th, when liquidity is poor and price discovery is uneven. Combined with Omeros’ long regulatory history and persistent ambiguity, binary risk remains elevated.

Corcept Therapeutics $CORT ( ▲ 3.23% ) — Relacorilant

PDUFA: Dec 30

Late-December decision timing introduces execution and liquidity considerations despite clearer precedent.

Outlook Therapeutics $OTLK ( ▲ 2.75% ) — ONS-5010

PDUFA goal date: Dec 31

Resubmission with well-understood risk factors. Year-end timing amplifies volatility.

PRECEDENT WATCH (ONE TO KEEP IN MIND)

Late-cycle extensions after draft labeling are not uniformly bearish. Historically, these scenarios often hinge on label narrowing or endpoint framing rather than outright approvability. This pattern shows up repeatedly in ophthalmology and inflammatory indications.

HOLIDAY NOTE — A FORMAT I’M TESTING (FREE)

With calendars slowing into the holidays, I’ve been experimenting with format rather than forcing coverage.

One thing I’ve been testing privately is a short FDA “Risk Dossier” - a structured regulatory pre-mortem that focuses on:

where an FDA decision can fail,

which precedents actually matter,

and what signals appear before the final action date.

As a thank-you to early readers (and to welcome new subscribers), I’m sharing one working example free:

PDUFA Risk Dossier: Aldeyra (ALDX) — Reproxalap

This is not a recommendation and not a finished product. It’s a live test of a format I may turn into a paid series in 2026 if it proves genuinely useful.

If it’s useful (or not), feel free to reply, feedback helps shape what I build next.

CLOSING NOTE

Year-end weeks are often where mispricing quietly builds. I’ll continue focusing on regulatory signal over noise, and we’ll shift back to denser calendar coverage as activity picks up.

More soon.

- PDUFA Pulse